[vc_row][vc_column][vc_custom_heading source=”post_title” use_theme_fonts=”yes” subtitle=”Effective and Structured steps for decision makers” el_class=”no_stripe”][stm_post_details][vc_column_text]Many a times, Purchasing Managers or Decision makers find it difficult to decide how to decide about India Sourcing? Or, they can’t think about the different factors they need to consider, for making India Sourcing decision. Here we are presenting a structured approach to help the decision makers.

Step No 1:

Start with the Existing Spend or Planned Spend in a year, from buyer’s own country. For new product of known commodity, it can be estimated by buyer, based on his experience. The idea is to get the Total Cost of Ownership. Not the Supplier’s Invoice value.

Total Cost of Ownership = Unit Price x Yearly Volume + other associated costs.

Step No 2:

Next step is to decide the target saving as per the company’s Purchasing objectives. This should be a realistic target.

Now, we arrive at a Target Spend. This Spend Target, defines the money, company is ready to outflow, for securing the Quality and Delivery, from outside suppliers.

Step 3:

To start we need 3 recurring costs:

- Manufacturing Cost in India. For this buyer can invite a few quotations from Indian suppliers. Or a sourcing company can help here. Refer for India Sourcing and Procurement Outsourcing here. The idea is to get the quotations validated for Ideal costing level in India.

- For transportation costs, there are free online resources available on internet to give estimates about Sea Freight, Port and clearance charges.

- The import duties as per H.S. code, are now getting available in public domain in importing country’s custom department’s website. For example: refer following link for duties in European Union.

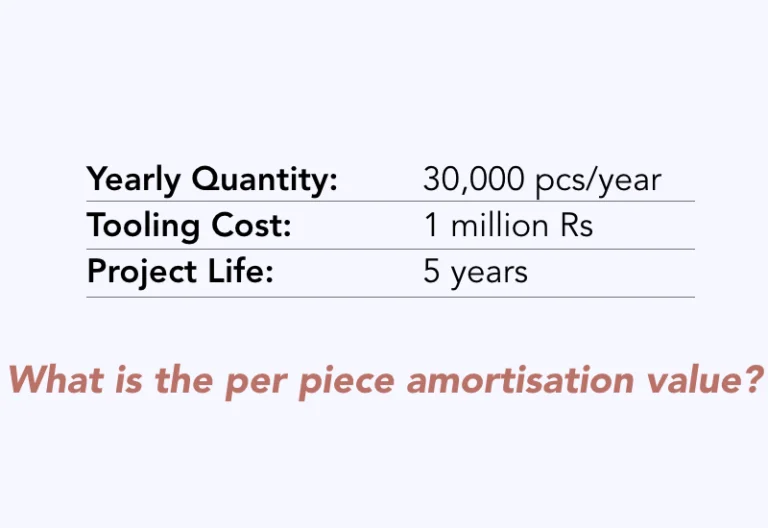

Once we have estimated the recurring costs, we should also add the set-up costs.

Set-up Costs includes:

- tooling cost,

- Hiring Consultants,

- Travel Cost,

- Supplier Validation,

- Factory Audit Cost etc.

Important Point:

Here is an important point, when the third bar is very high compared to second bar. Or in other words if you get the cost from India higher than manufacturing cost in developed countries. The decision maker should, re-validate the study, to find strong reasons before closing the study.

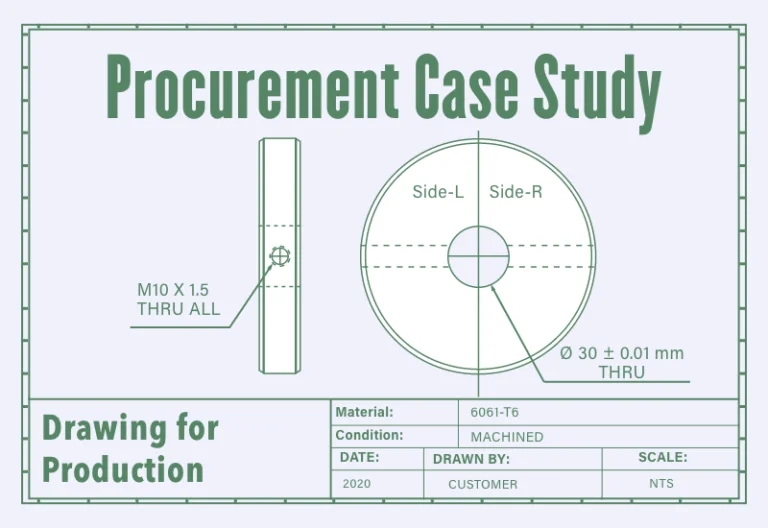

This may be due to different assumptions taken by, overseas buyer and Indian manufacturer. Some of the examples of different assumptions are as follows:

- Supplier have decided to manufacture through only machining route, whereas Buyer need Die casting and machining

- Manufacturer is quoting considering very high tolerances, whereas the part doesn’t require very high tolerances.

- Indian Supplier is considering additional operation which is not required by buyer.

Final Step:

Once all the costs are added up we should also add the final bit, that is, Buyer’s Administration cost. Which will include likes of Import cost, communication cost. Or additional manpower cost for managing import from India.

Submission:

If adding the administrative costs keeps you within the target, it is clear that you should source at your own.

In case adding the administrative costs is taking you beyond the target, then we submit you 2 insights:

- If the gap for administrative cost space is around $ 40,000 per year, then it is advisable to think about setting an office in India.

- The cases where administrative cost space is between $ 10,000 – $ 40,000 per year, then it is advisable to hire a sourcing company as they have shared resources.

- Having administrative cost space below $ 10,000 dollars per year, it is better to buy in bulk from supplier and stock.

The above submissions are based on author’s understanding only and doesn’t guarantee any outcome.

Please let me know your comments or questions on this framework by email at info@apogeesourcing.com[/vc_column_text][stm_post_bottom][/vc_column][/vc_row][vc_row][vc_column][vc_cta h2=”Have a question about this? Email the author !” h2_font_container=”font_size:20px|color:%23000000|line_height:24px” h2_use_theme_fonts=”yes” shape=”square” style=”flat” add_button=”right” btn_title=”Email” btn_style=”flat” btn_color=”theme_style_2″ btn_align=”right” btn_i_align=”right” btn_i_icon_fontawesome=”stm-stm14-arrow” use_custom_fonts_h2=”true” btn_button_block=”true” btn_add_icon=”true” btn_link=”url:mailto%3Ainfo%40apogeesourcing.com|||” el_class=”third_bg_color”][/vc_cta][/vc_column][/vc_row]